Why does startupbooted forex appear in search results, forums, and articles—yet almost no source explains it clearly?

Some pages hint at a trading platform. Others reference it alongside brokers or forex tools. A few imply trading potential without ever stating whether real money is involved. For beginners, that uncertainty creates hesitation—and sometimes costly assumptions.

The reality is simpler than it looks.

As of 2025, StartupBooted Forex is not a broker, not a trading platform, and not a system that executes trades. It appears mainly in educational, analytical, and discussion-based content related to forex trading.

This article cuts through the ambiguity. You’ll learn what StartupBooted Forex actually represents, where it shows up online, how traders use it in practice, and how to evaluate it safely as part of a broader forex learning journey. No hype, no promises—just clear context.

What StartupBooted Forex Actually Is

StartupBooted Forex is best described as an informational reference point rather than a functional trading service.

It commonly appears:

-

In educational articles discussing forex trading concepts

-

Within fintech or startup-focused content

-

Alongside comparisons of trading platforms or learning resources

-

In blog posts and discussion-style pages—not in regulated broker listings

What it is

-

An educational or informational reference

-

Part of online trading discussions

-

A context where forex concepts, tools, and risks are explained

What it is not

-

❌ A regulated forex broker

-

❌ A platform that executes trades

-

❌ A service that handles deposits or withdrawals

-

❌ A forex bot, signal service, or profit system

This distinction is critical, especially for new traders navigating an already complex market.

Where StartupBooted Forex Appears Online (Real Examples)

Rather than existing as a standalone trading product, StartupBooted Forex typically appears:

-

In SEO-driven explainer articles

-

On startup or fintech blogs

-

Within educational trading discussions

-

Referenced indirectly when discussing how traders learn forex basics

Notably, it does not appear:

-

On broker comparison sites listing regulated entities

-

In regulatory databases (FCA, ASIC, CySEC, NFA)

-

Inside trading terminals or platforms like MT4/MT5

This absence supports the conclusion that it functions as content, not infrastructure.

Where StartupBooted Forex Fits in the Forex Ecosystem

Understanding its role requires a clear view of the forex trading landscape.

The forex ecosystem at a glance

| Layer | Function |

|---|---|

| Brokers | Hold accounts and execute real trades |

| Trading platforms | Provide charts, orders, and execution |

| Educational resources | Teach strategies and concepts |

| Trading communities | Share experiences and insights |

| Analysis & reference sites | Explain tools and market behavior |

StartupBooted Forex fits squarely in the educational and reference layers, not the execution layer.

It helps traders understand trading, not perform trading.

How Traders Actually Use StartupBooted Forex

In real-world usage, traders don’t “trade on” StartupBooted Forex. They use it earlier in the learning curve.

Practical use cases

-

Understanding how forex trading involves leverage and risk

-

Learning basic risk management principles

-

Comparing types of trading platforms

-

Preparing before opening demo accounts

-

Building foundational forex education before using real money

Typical trader path

-

Learn concepts from educational resources

-

Practice with demo accounts

-

Choose a regulated broker

-

Execute trades on a trading platform

-

Track performance metrics independently

StartupBooted Forex usually appears at step one.

StartupBooted Forex vs Real Trading Platforms

| Feature | StartupBooted Forex | Trading Platform |

|---|---|---|

| Trade execution | ❌ No | ✅ Yes |

| Real money involved | ❌ No | ✅ Yes |

| Market access | ❌ No | ✅ Direct |

| Educational focus | ✅ Yes | ⚠️ Limited |

| Risk exposure | ❌ None | ✅ High |

| Customer support | Informational | Operational |

| Real-time trading | ❌ No | ✅ Yes |

Bottom line: StartupBooted Forex explains the game—it doesn’t place bets.

A Practical Evaluation Framework (Use This Before Trusting Any Forex Resource)

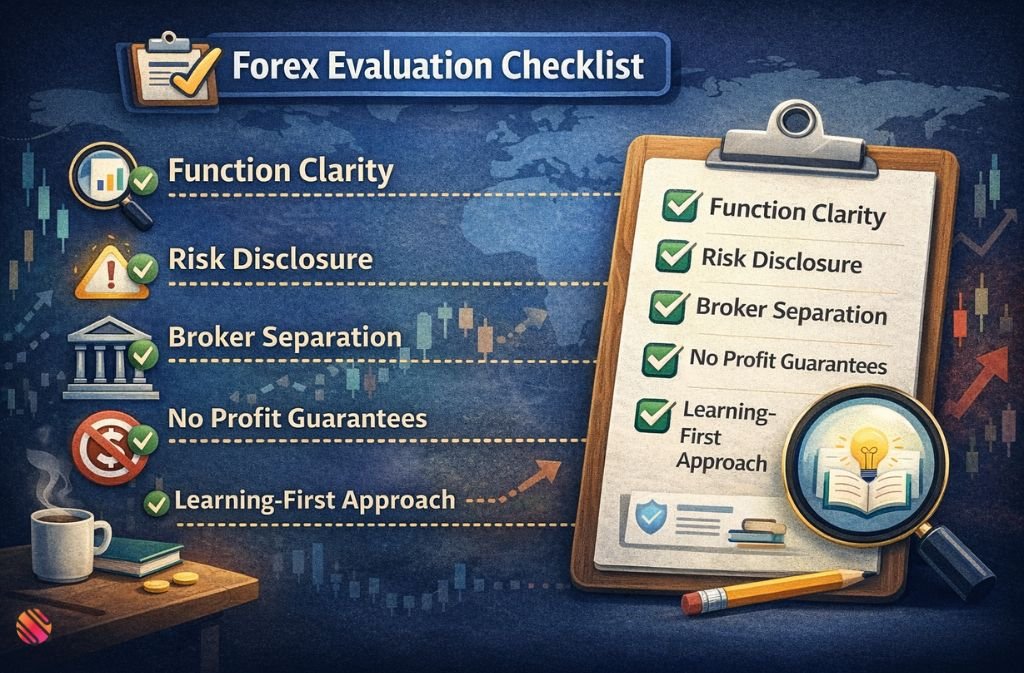

Use this 5-point checklist to judge StartupBooted Forex—or any similar resource.

-

Function clarity – Does it explain or execute trades?

-

Risk disclosure – Are losses and volatility discussed openly?

-

Broker separation – Are brokers clearly distinguished from content?

-

No profit guarantees – Are expectations realistic?

-

Learning-first approach – Is long-term skill emphasized?

Educational resources that pass all five checks are generally safe to use for learning.

Common Misunderstandings (And Why They Matter)

“StartupBooted Forex is a broker.”

It isn’t. No accounts, no execution, no regulation.

“It can help me make guaranteed profits.”

No legitimate forex education source can guarantee profits. Claims like that are red flags.

“Education alone is enough.”

Education reduces mistakes—but demo trading and experience are still essential.

Is StartupBooted Forex Safe?

From a financial-risk standpoint, yes—because it doesn’t handle money.

The real risk comes from misinterpretation:

-

Treating education as a signal service

-

Skipping demo practice

-

Ignoring risk management

-

Expecting short-term income

Used as intended, it’s a low-risk learning resource.

The 2025 Reality of Forex Trading

According to widely cited industry data (e.g., broker disclosures and independent forex statistics), approximately 70–90% of retail forex traders lose money. This is why regulators require brokers to display risk warnings and why education alone never replaces discipline.

StartupBooted Forex does not contradict this reality—and that’s a good sign.

FAQs

Q1. Can you make $100 a day on forex trading?

Some traders manage to earn $100 a day, but consistent profits are rare. Daily results depend on factors like trading capital, strategy, market conditions, and strict risk management—not merely reading educational websites or reference resources like StartupBooted Forex. Beginners should focus on learning and demo practice first.

Q2. How do traders try to turn $100 into $1000 in forex?

Turning $100 into $1000 usually involves high-risk leverage trading, which can lead to significant losses rather than sustainable growth. Smart traders prioritize risk management, gradual account growth, and education instead of chasing quick wins.

Q3. What is the 90% rule in forex trading?

The 90% rule highlights that the majority of retail forex traders lose money—typically around 70–90%. This statistic emphasizes the importance of forex education, demo trading, and disciplined strategies, rather than relying on shortcuts or unverified platforms.

Q4. Do forex bots really work for consistent profits?

Forex bots automate trading strategies, but they cannot eliminate risk. Poor market conditions can quickly lead to losses, even with automated systems. Using bots effectively requires understanding market behavior and strict risk controls.

Q5. Is StartupBooted Forex suitable for beginners?

Yes. StartupBooted Forex is primarily a learning and discussion resource, ideal for beginners exploring forex concepts. It works best when paired with demo accounts and structured forex education.

Q6. Does StartupBooted Forex involve real money trading?

No. StartupBooted Forex does not execute trades or handle funds. It is an educational and discussion-based resource, not a broker or trading platform. Its role is to help traders understand the market before using real money.

Conclusion

StartupBooted Forex is not a broker, not a trading platform, and not a shortcut to profits. It’s an educational and discussion-based reference that helps traders understand forex before entering real markets.

Its value lies in clarity, not execution. Used correctly, it supports smarter decisions and better preparation. Used incorrectly, it creates false expectations.

In 2025, the responsible trading path remains unchanged:

learn → practice on demo accounts → trade cautiously with regulated brokers.

That’s where StartupBooted Forex fits—and where its role ends.

Related: Bvostfus Python: Real Tool or SEO Myth? (2025)

Disclaimer: This article is for educational purposes only. StartupBooted Forex is not a broker or trading platform. Forex trading carries significant risk, and you should use demo accounts and consult a licensed financial advisor before making any financial decisions.