Zelle processes billions of dollars in payments every year, yet it doesn’t charge users transaction fees, subscription costs, or commissions. That alone makes people suspicious.

So naturally, one question keeps coming up on Google and Reddit alike: how does Zelle make money?

If you’ve ever sent money instantly through your banking app and wondered, “What’s the catch?”, you’re not alone. Unlike Venmo or Cash App, Zelle doesn’t run ads, upsell premium features, or skim a percentage off your transfers.

This article breaks down exactly how Zelle makes money in 2025, why banks support it, and why the business model looks invisible to consumers—but extremely valuable behind the scenes.

You’ll learn:

-

Who actually owns Zelle

-

Why Zelle doesn’t charge fees (and likely never will)

-

How banks indirectly profit from Zelle

-

The real tradeoffs users should understand

-

How Zelle’s model compares to Venmo and Cash App

No hype. No jargon. Just a clear, practical explanation.

What Is Zelle and Who Owns It?

Zelle is a peer-to-peer (P2P) payment network that allows users to send and receive money directly between U.S. bank accounts using a phone number or email address.

Unlike most digital payment platforms, Zelle is bank-owned.

Zelle ownership explained

Zelle is operated by Early Warning Services (EWS), a fintech company owned by major U.S. banks, including:

-

JPMorgan Chase

-

Bank of America

-

Wells Fargo

-

U.S. Bank

-

PNC

-

Capital One

This ownership structure is the key to understanding Zelle’s revenue model.

Zelle is not designed to monetize users. It’s designed to protect banks.

How Does Zelle Make Money?

Zelle does not make money directly from users.

Instead, it:

-

Charges participation and service fees to banks

-

Helps banks retain customers

-

Reduces fraud and customer churn

-

Prevents money from flowing to rival apps

Zelle is a defensive infrastructure play, not a consumer revenue engine.

Let’s break that down.

Zelle’s Business Model Explained (Step by Step)

1. Banks Pay Zelle — Not You

Banks and credit unions pay Zelle to be part of the network. These costs can include:

-

Network participation fees

-

Technical integration costs

-

Ongoing maintenance and compliance

From the bank’s perspective, this is cheaper than:

-

Losing customers to Venmo or Cash App

-

Handling ACH delays and disputes

-

Managing fragmented payment systems

Zelle functions as shared banking infrastructure, similar to credit card networks—but without consumer fees.

2. Zelle Helps Banks Keep Their Customers

This is where the real value lies.

Before Zelle:

-

Users downloaded third-party apps

-

Linked their bank accounts

-

Left the banking ecosystem

With Zelle:

-

Payments happen inside the bank’s own app

-

Customers log in more frequently

-

Banks stay central to everyday money movement

Higher engagement = higher lifetime customer value.

That’s how banks profit—even if Zelle itself doesn’t.

3. Faster Payments Reduce Bank Costs

Zelle transfers are typically instant, settling directly between bank accounts.

This reduces:

-

Customer service costs

-

Payment disputes

-

Manual intervention

-

ACH processing overhead

From an operational standpoint, Zelle saves banks money while improving user experience.

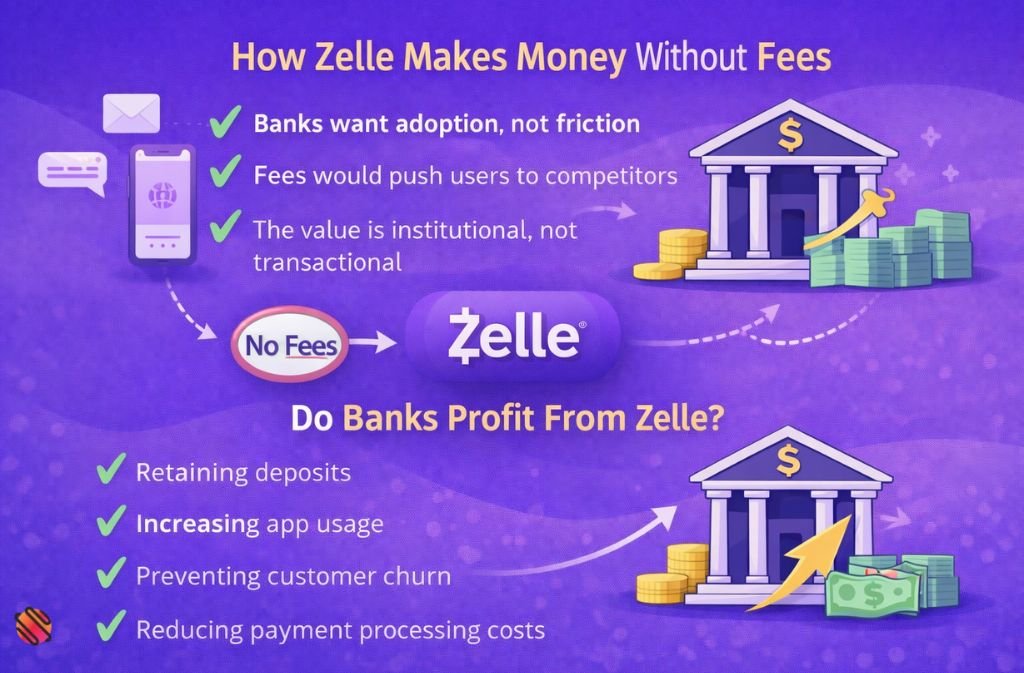

How Zelle Makes Money Without Fees (Why This Confuses People)

Zelle’s no-fee model feels unusual because most fintech apps monetize users directly.

Zelle does the opposite.

Why Zelle doesn’t charge users

-

Banks want adoption, not friction

-

Fees would push users to competitors

-

The value is institutional, not transactional

Zelle is closer to email or SMS than a traditional fintech app. It’s infrastructure.

That’s why asking “Does Zelle take a percentage of your money?” misses the point.

Do Banks Profit From Zelle?

Yes—but indirectly.

Banks profit from Zelle by:

-

Retaining deposits

-

Increasing app usage

-

Preventing customer churn

-

Reducing payment processing costs

Zelle strengthens the bank–customer relationship, which is far more valuable than transaction fees.

Zelle vs Venmo vs Cash App: How the Models Differ

| Feature | Zelle | Venmo | Cash App |

|---|---|---|---|

| User fees | None | Optional | Optional |

| Ads | No | Yes | No |

| Owned by banks | Yes | No | No |

| Revenue source | Banks | Users + ads | Users + financial products |

| Payments | Bank-to-bank | Wallet-based | Wallet-based |

The Zelle app is built for stability and scale, not growth hacks.

Real-World Example: Why Banks Back Zelle

Imagine a customer who:

-

Uses Venmo for payments

-

Keeps a minimal balance in their bank

-

Interacts with their bank once a month

Now compare that to:

-

A Zelle user sending money weekly

-

Logging into their bank app regularly

-

Keeping funds in their checking account

Banks choose Zelle every time.

Downsides of Zelle (What Users Should Know)

Zelle isn’t perfect—and competitors often skip this.

Key limitations

-

No buyer protection

-

No payment reversal for mistakes

-

Limited fraud recovery

-

U.S.-only network

Zelle is designed for trusted payments, not online marketplaces.

Is Zelle Shutting Down in 2025?

No.

Rumors about Zelle shutting down usually stem from:

-

Bank-specific app changes

-

Confusion with third-party integrations

As of 2025, Zelle remains fully operational and expanding within bank apps.

Common Mistakes People Make When Using Zelle

-

Sending money to strangers

-

Assuming payments can be reversed

-

Confusing Zelle with escrow services

-

Treating it like Venmo for purchases

Zelle is best used like digital cash.

The Future of Zelle’s Business Model (2025–Beyond)

Zelle is unlikely to:

-

Add ads

-

Charge users

-

Introduce premium tiers

More likely developments:

-

Expanded fraud detection

-

Deeper bank integrations

-

Smarter payment controls

-

Tighter security features

Its role as banking infrastructure will only grow.

FAQs

Q. Does Zelle take a percentage of your money?

No, Zelle does not take a percentage of your money or charge transaction fees. When you send or receive money using Zelle, the full amount goes to the recipient. The service is funded by participating banks, not by users.

Q. How does Zelle make money without fees?

Zelle makes money without fees by charging participating banks and credit unions, not end users. Banks pay to access Zelle’s payment network because it helps them retain customers, reduce transfer costs, and keep payments inside their own banking apps.

Q. Do banks pay Zelle?

Yes. Banks and credit unions pay Zelle as part of their digital payment infrastructure. These payments cover network access, system maintenance, and security. In return, banks get a fast, in-app peer-to-peer payment system without relying on third-party apps.

Q. Is Zelle safer than Venmo?

Zelle is secure but offers less buyer protection than Venmo. Zelle transfers move directly between bank accounts and are best used for sending money to people you trust. Venmo offers more consumer protections for purchases, while Zelle focuses on speed and bank-level security.

Q. Why don’t banks just build their own payment system?

Banks already did—Zelle is their shared payment system. Instead of building separate networks, major banks collaborated on Zelle to reduce costs, improve compatibility, and compete with fintech apps like Venmo and Cash App more efficiently.

Q. Can Zelle become paid in the future?

It’s unlikely. Charging users would undermine Zelle’s core purpose, which is frictionless, bank-to-bank payments. Zelle’s value comes from widespread adoption and bank support, not user fees, making a paid model improbable as of 2025.

Conclusion

So, how does Zelle make money?

It doesn’t—at least not the way most people expect.

Zelle exists to help banks:

-

Keep customers

-

Reduce costs

-

Compete with fintech apps

-

Control the payment layer

For users, that means fast, free transfers—but also fewer protections.

Understanding this tradeoff helps you use Zelle the right way.

Related: StartupBooted Forex Explained: What It Is (and Isn’t) in 2025

| Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or banking advice. Features, policies, and fees related to Zelle may vary by bank and are subject to change. Readers should verify details directly with their financial institution before making payment decisions. |